Tether 的 USDT 明顯是穩定幣市場的王者。為什麼還要考慮該用哪個穩定幣呢?錯了。其實有很多因素需要思考,也有其他值得留意的選項。最明顯的替代品當然是 Circle 的 USDC。但還有更有潛力的新星。其中一個最具發展潛力的是源於香港的 FDUSD。

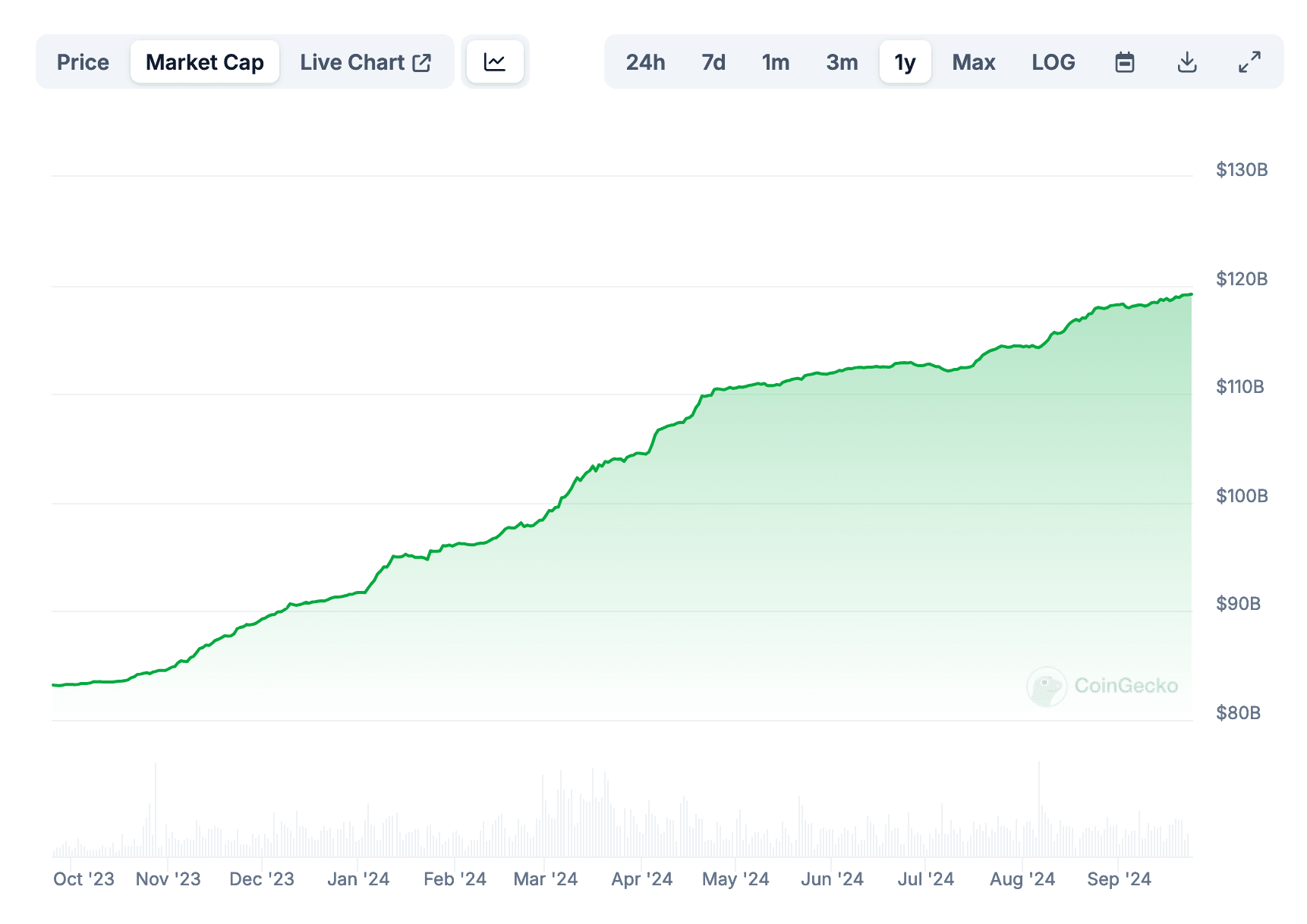

正如我們先前提過,Tether 已接近創下 1,200 億美元的歷史性市值。

是時候將主要的穩定幣進行正面比較,看看2024年最值得使用的是哪一種。

認識穩定幣:穩定幣是什麼?我們為什麼需要它?

穩定幣迅速演變成加密貨幣生態不可或缺的一環。為什麼呢?因為它們架起了動盪數位資產世界與傳統法定貨幣的橋樑。

它們的重要意義在於能為加密市場提供穩定的交換媒介與價值儲存功能。它們有效降低像比特幣、以太坊等加密貨幣的價格波動帶來的風險。不管整體加密市場如何波動,穩定幣的價值都保持不變。

因此,不論交易者、投資人或機構,穩定幣都適合作為交易、避險或進行去中心化金融服務的重要工具。

穩定幣的崛起不僅讓交易體驗更流暢,也對推動去中心化金融(DeFi)發展具有關鍵作用。它們已成為加密交易平台流動性的重要基石,也是市場劇烈波動時的安穩避風港。

在眾多穩定幣之中,Tether(USDT)、USD Coin(USDC)已躍升成為領頭者,各自帶來不同的特色、合規方式與市場整合方式。

同時也有新挑戰者不斷出現,比如 First Digital USD(FDUSD),有效衝擊既有領頭羊。

這些穩定幣雖擁有維持穩定價值的共同目標,卻在運作模式、法規合規、透明度、技術集成等方面存在差異。

想要善用穩定幣,了解這些差異與特點對於達成自我目標至關重要。

穩定幣霸主地位與近況

穩定幣發展勢頭強勁。

截至2024年9月,穩定幣總市值已超過1,690億美元,較2023年10月的1,220億美元大增38.5%。

Tether(USDT)持續主導穩定幣市場,以驚人的1,200億美元市值、70.4%的佔比穩坐龍頭。這主要歸功於持續而穩定的資金流入,以及其在各大交易所和平台的廣泛採用。

他們也不斷抓住機會壯大實力。

僅在過去一個月,Tether 就在以太坊區塊鏈新增發行了10億枚,在波場發行了1億枚。

其他穩定幣同樣動作積極。

Circle 的 USDC 維持穩定增長,在多方面幾乎趕上 USDT。

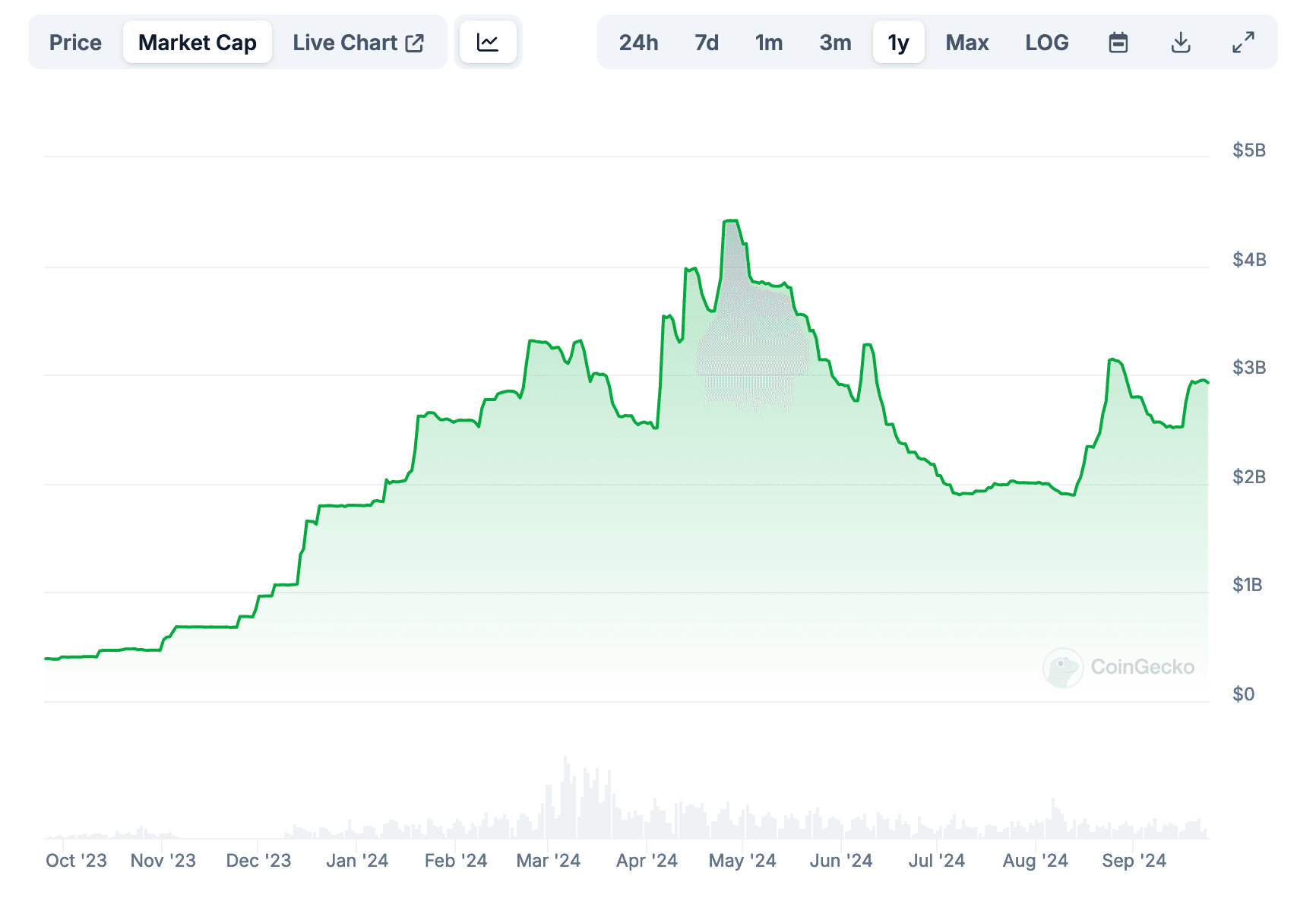

而新秀 First Digital USD(FDUSD)表現尤為亮眼。

過去30天 FDUSD 市值增長了47%,達到29.4億美元。這種快速發展顯示市場對提供不同功能或符合區域監管規範的替代穩定幣需求殷切(細節後述)。

穩定幣規模增長受多重因素影響。

全球通脹疑慮,讓個人與機構尋求能保值又不受傳統加密幣劇烈波動影響的資產。在阿根廷、南非等國,因對政府與財政政策信任薄弱,人們更願意信賴穩定幣。

法幣逐漸貶值,推動穩定幣成為保護財富、進行國際交易的工具,且不受傳統銀行體系(往往腐敗或反覆無常)約束。

同時,穩定幣已成為DeFi平台上老練交易者的多功能利器。用戶可將手上的穩定幣出借、借款、賺取利息,更加深與數位金融的結合。

接下來,讓我們看看兩大穩定幣——USDT與USDC——與急速崛起的新星FSUSD三者的差異。

Tether(USDT)——歷史與財務資訊

Tether(USDT)於2014年推出,是首個提出綁定美元1:1的數位代幣,開創了穩定幣概念。

當時此想法曾讓許多人疑惑:“誰會需要一個數位版的美元?”然而,時間證明其遠見。

Tether 的創新為加密貨幣交易者提供了解決價格波動難題的新方法。用戶可以在不必來回兌換法幣下快速操作加密貨幣部位,節省時間及手續費。

USDT 現在的市值已增至約1,190億美元,反映其在加密領域的高度接受度與信任度,即使外界爭議不斷。 USDT 為眾多交易所提供流動性,鞏固其在加密基礎建設中的重要地位。對某些用戶來說,USDT 才是加密市場的真正血液,而不是比特幣或以太幣。

<u>USDT市值,過去12個月 / CoinMarketCap</u>

更值得注意的是,USDT 近期在交易總價值上超越了 Visa。另一項成功關鍵是 USDT 在多條區塊鏈上發行。實際上,Tron 上的 USDT 交易速度比以太坊更快,手續費也較低。

不過,每朵玫瑰都有刺,USDT 也不例外。

Tether 一直受到監管單位與業界對其儲備透明度的質疑。

各界關注 Tether 是否擁有足夠資產完全覆蓋在外流通的 USDT 代幣。

過去,Tether 宣稱USDT全數由美元儲備支撐,但後來公開資料顯示儲備資產其實包含了現金、等價物及各種商業票據、貸款等。

2024年,Tether 上半年淨利達52億美元,主要來自美國國債與其他投資資產。儘管收益可觀,但其儲備透明度問題持續遭質疑。

官方機構不斷施壓要求 Tether 公開完整持有資產的審計報告,造成一定的監管緊張。缺乏獨立審核與完全公開報表,仍是影響 Tether 長期發展及用戶信心的一大隱憂。

如果你打算將自己資產交給Tether,這點務必要再三思考。

USD Coin(USDC)——歷史與財務資訊

USD Coin(USDC)於2018年由 Circle 和 Coinbase 兩大加密產業知名企業合作發行。

從設計之初,USDC 即強調法規合規與透明度,定位為穩定幣市場可信賴的新選擇。這裡的「其他」當然指的是當時已居主流的 Tether(USDT)。

Circle 做事風格也確實與眾不同。

USDC 採取嚴格的儲備政策,確保每枚 USDC 由獨立帳戶持有的 1:1 美元資產支撐,並由知名會計師事務所 Grant Thornton LLP 每月出具資產證明,增加公信力。

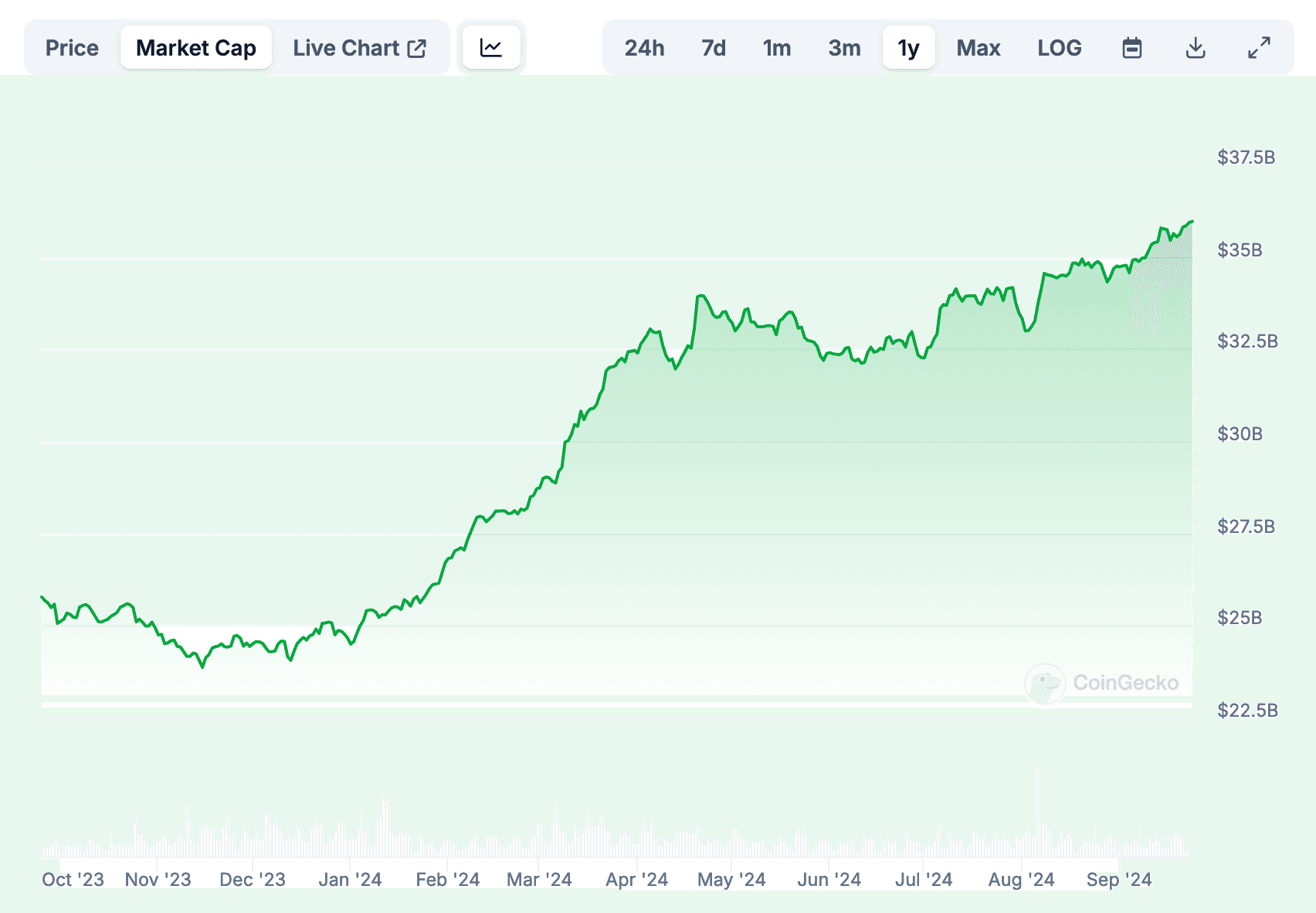

到2024年,USDC 市值約為 358.8 億美元,僅次於 Tether,躍居第二。USDC 在機構投資者、DeFi 生態尤其受青睞,因其高度透明與合規。

<u>USDC 市值,過去12個月 / CoinMarketCap</u>

簡而言之,對許多用戶來說,USDC 比常陷入風波、總被監管單位關注的 USDT 更為透明可靠。

USDC 之所以可順利整合進全球金融體系,得力於與各大金融機構及科技企業的策略合作。

它也是歐洲 MiCA 法規合規範例,展現了 USDC 與時俱進的監管自律。有這種態度,也就和 USDT 形成了鮮明對比。

主動擁抱監管,不僅擴大用戶群,也讓 USDC 在數位資產未來發展的討論中保持有利位置。

和它的「頭號對手」一樣,USDC 也支持多條公鏈,除以太坊外還有 Algorand、Solana、Stellar 等。

First Digital USD(FDUSD)——歷史與財務資訊

First Digital USD(FDUSD)是穩定幣陣容的... stablecoin market. It was launched by First Digital Trust, a Hong Kong-based financial institution specializing in custody and asset servicing solutions. FDUSD aims to provide a secure and compliant stablecoin option, particularly catering to the Asian market.

穩定幣市場。FDUSD 由香港金融機構 First Digital Trust 推出,該公司專注於託管及資產服務解決方案。FDUSD 旨在為市場提供一個安全且符合法規要求的穩定幣選擇,特別針對亞洲市場的需求。

Despite its relatively recent entry, FDUSD has already achieved significant growth.

儘管 FDUSD 進入市場的時間相對較短,但已經取得顯著成長。

Over the last 30 days, its market capitalization surged by 47%, reaching $2.94 billion.

在過去 30 天內,其市值成長了 47%,達到 29.4 億美元。

This rapid ascent can be attributed to several factors.

這一快速崛起可歸因於多項因素。

FDUSD emphasizes full compliance with regional regulations, appealing to users and institutions in jurisdictions where regulatory oversight is stringent. It’s much closer to USDC than to USDT in this regard.

FDUSD 強調全面遵守地區監管法規,對於受嚴格法規監管的地區用戶及機構頗具吸引力。在這方面,FDUSD 與 USDC 更為接近,而非 USDT。

Full Asset Backing is also a thing here. FDUSD is committed to maintaining full reserve backing, providing users with confidence that each token is redeemable for its equivalent value in U.S. dollars. That helps build trust, to say the least.

“全額資產儲備”也是其重點。FDUSD 承諾維持全額儲備,讓用戶相信每個代幣都可兌換等值美金。這有助於提升信任度。

Also worth mentioning that FDUSD's integration into major offshore exchanges has enhanced its liquidity and accessibility, making it a viable alternative to established stablecoins like USDT.

值得一提的是,FDUSD 已整合至主要離岸交易所,提升了其流動性與可取得性,使其成為 USDT 等主流穩定幣的可行替代方案。

<u>FDUSD Market Cap, Last 12 Month / CoinMarketCap</u>

Focus on Cross-Border Transactions is the killer feature of FDUSD. The new Asian-born stablecoin is designed to facilitate efficient cross-border payments, addressing a critical need in global finance, especially in regions where traditional banking services may be limited or costly.

注重跨境交易是 FDUSD 的殺手級功能。這款亞洲誕生的新穩定幣專為促進高效跨境支付而設計,解決了全球金融的一項關鍵需求,特別是在傳統銀行服務有限或昂貴的地區。

While FDUSD's market share remains small compared to USDT and USDC, its growth trajectory and strategic positioning suggest that it could become a significant player in the stablecoin arena. Particularly within specific regional markets, but there a sign of the gaining popularity worldwide.

雖然 FDUSD 的市佔率仍遠小於 USDT 與 USDC,但其成長趨勢與策略布局,顯示其有望成為穩定幣領域的重要角色。尤其在特定區域市場表現突出,且已顯現全球普及跡象。

USDT, USDC, and FDUSD: Comparative Analysis - Resilience, Sustainability, and Reputation

USDT、USDC 與 FDUSD:比較分析-韌性、可持續性與聲譽

The stablecoins USDT, USDC, and FDUSD, while sharing the fundamental goal of maintaining a stable value pegged to the U.S. dollar, differ markedly in their approaches to operational transparency, regulatory compliance, technological integration, and market strategies.

穩定幣 USDT、USDC 與 FDUSD 都以維持與美元掛鉤的穩定價值為主要目標,但在營運透明度、法規遵循、技術整合及市場策略等方面卻有明顯差異。

A deep analysis of these differences is essential to understand their respective positions in the market and potential future developments. This is how you define where to put your money.

深入分析這些差異,有助於了解其在市場中的定位與未來發展潛力,這對於投資人資金配置至關重要。

Operational Transparency and Reserve Management

營運透明度與儲備管理

As we mentioned above, USDT has historically been less transparent about its reserve holdings.

正如前述,USDT 在儲備資產透明度方面一直較為不足。

While Tether has provided periodic attestations and reports, these have not always satisfied regulatory authorities or critics who demand full audits by reputable third parties. The composition of USDT's reserves has been a focal point of concern, with a significant portion previously held in commercial paper and other assets rather than cash equivalents. This lack of full transparency raises questions about Tether's ability to meet redemption demands during periods of high market stress. The more people withdraw their assets the more pressure Tether will experience.

雖然 Tether(USDT 發行方)有定期出具聲明與報告,但這通常無法令監管機關或要求完全第三方審計的批評者滿意。USDT 儲備結構一直備受爭議,尤其過去大部分資產並非現金等價物,而是商業票據等其他資產。透明度不足,讓人質疑 Tether 在市場壓力下能否滿足贖回需求。贖回的人愈多,Tether 所承受的壓力愈大。

In contrast, USDC has built its reputation on operational transparency.

相較之下,USDC 則以營運透明贏得聲譽。

Circle, the issuer of USDC, provides regular, detailed attestations of its reserves, conducted by Grant Thornton LLP. These reports include information about the types of assets held and confirm that reserves are held in segregated accounts. USDC's commitment to transparency extends to compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which enhances its credibility among regulators and institutional users.

USDC 發行方 Circle 會定期發布儲備資產的詳細報告,並由 Grant Thornton LLP 審核。這些報告揭露資產種類,並證明儲備存放於隔離帳戶。USDC 的透明度承諾也延伸至 KYC 與 AML (反洗錢)合規,從而提升了其在主管機關與機構用戶之間的信譽。

FDUSD also emphasizes full asset backing and regulatory compliance.

FDUSD 同樣強調全額資產儲備與法規合規。

But as a newer stablecoin, FDUSD has yet to establish a long-term track record of transparency. Its association with First Digital Trust, a regulated entity, adds a layer of credibility. However, FDUSD will need to continue building trust through consistent, transparent reporting and independent audits to solidify its reputation. If it manages to go further with no scandals and questionable moments, it will further drift in the wake of USDC. This will mark contrast with USDT and make the competition even sharper.

不過身為新興穩定幣,FDUSD 仍需時間建立長期的透明度紀錄。其母公司 First Digital Trust 擁有合規認證,為其增加信譽。然而,FDUSD 仍必須持續透過公開透明報告與獨立審計來建立信任。如能避免醜聞及爭議並不斷邁進,FDUSD 有望逐步朝向 USDC 的路線發展。屆時與 USDT 的對比將更加鮮明,競爭更加激烈。

Regulatory Compliance and Global Integration

法規合規性與全球整合

Would you rather entrust your savings or operational assets to an entity that is 100% legal or to an entity that is regularly on the brink of a war with the authorities. Well, unless you are a Pavel Durov’s fan, the answer it kind of obvious.

你會將自己的資產交給一個 100% 合法合規的機構,還是一個時常與監管機構對立、官司不斷的公司?除非你是 Pavel Durov 的粉絲,否則答案應該很明顯。

Regulatory compliance is a critical differentiator among stablecoins, influencing their adoption and integration into the global financial system.

法規遵循是穩定幣之間的重要區隔,深深影響其在全球金融市場的應用與整合。

Once again, USDT has faced regulatory challenges, including investigations and fines related to its reserve disclosures and operations. These issues have led to restrictions in certain jurisdictions and have prompted some institutions to limit or avoid using USDT due to compliance concerns.

USDT 近年來不斷因儲備資訊揭露及營運相關議題而面臨監管調查及罰款。這些問題導致部分地區有限制,也讓不少機構因合規風險選擇限制或放棄使用 USDT。

For instance, with the implementation of MICA, many European services and platforms are about to get rid of USDT. That includes even Binance in many countries of the EU.

舉例來說,隨著 MICA 法規推動,不少歐洲金融平台和服務開始淘汰 USDT,甚至連 Binance 在多個歐盟國家也將其下架。

That might mean nothing to you if you come from other parts of the world, but in Europe USDT seems to be on the verge of loosing its leading positions.

如果你不在歐洲,這或許與你無關,但在歐洲市場,USDT 明顯正在失去龍頭地位。

USDC has proactively engaged with regulators and designed its operations to meet regulatory requirements in key markets. Its compliance with the MiCA regulation in Europe and adherence to U.S. financial regulations position USDC as a stablecoin that can be confidently used by institutions and entities that operate within strict regulatory environments.

USDC 積極主動與監管單位溝通,制定營運流程來滿足主要市場的法規要求。其遵循歐洲 MiCA 指令、以及美國財金法規,讓 USDC 成為能被嚴格法規環境下機構與企業安心採用的穩定幣。

You might not like the fact that you have to explain to your business partners why are you choosing USDC instead of USDT, but in terms of legal hurdles, USDC looks a more clear choice.

你可能不喜歡向合作夥伴解釋選 USDC 而非 USDT 的理由,但從法律障礙來看,USDC 顯然較為「安全明確」。

FDUSD operates within the regulatory framework of Hong Kong and other Asian jurisdictions. Its focus on compliance in these regions makes it an attractive option for users and businesses operating in Asia. As global regulatory landscapes evolve, FDUSD's ability to navigate and comply with international regulations will be crucial for its expansion. Experts have no doubts that FDUSD is going to comply to all kinds of legal demand as the widespread adoption rises. That makes it a one more tough competitor to USDT.

FDUSD 根據香港與亞洲相關法規架構營運,專注於區域合規,使其對區域用戶與企業極具吸引力。隨著全球監管趨勢變化,FDUSD 能否持續靈活應對國際法規也是其後續發展關鍵。專家普遍認為,FDUSD 廣泛被採用後,法規遵循應會非常徹底,也使其成為 USDT 更嚴峻的競爭對手。

Technological Integration and Ecosystem Participation

技術整合與生態參與

It’s difficult to directly compare transaction speeds and fees of USDT, USDC, and FDUSD due to the fact they operate on different blockchains. But still there is some info you should be familiar with.

由於 USDT、USDC、FDUSD 分別在不同區塊鏈運行,直接比較其轉帳速度及費用較為困難。不過還是有一些資訊值得了解。

USDT (Tether) is available on multiple blockchains, including Ethereum (ERC-20), Tron (TRC-20), and others like Solana and Binance Smart Chain.

USDT(Tether)支援多條區塊鏈,包括 Ethereum(ERC-20)、Tron(TRC-20)及 Solana、Binance Smart Chain 等。

On the Ethereum network, USDT transactions can experience slower speeds and higher fees due to network congestion and elevated gas prices (sometimes reaching a few dollars per 100 dollars sent). In contrast, USDT on the Tron network offers faster transaction speeds and significantly lower fees, making it a popular choice for users who prioritize cost-efficiency and quick transfers.

在 Ethereum 網路上,USDT 轉帳經常遇到網路塞車及高昂 gas 費,轉帳 100 美元可能會被收取幾美元手續費;而在 Tron 網路的 USDT 則具有更快速度及較低費用,因此受到注重成本及速度使用者的青睞。

USDC (USD Coin) also operates on several blockchains such as Ethereum, Algorand, Solana, and Stellar. Similar to USDT, USDC transactions on Ethereum can be costly and slower because of network congestion.

USDC(USD Coin)同樣分布於 Ethereum、Algorand、Solana 和 Stellar 等多條區塊鏈。類似 USDT,USDC 在 Ethereum 上的轉帳費高且慢。

However, on networks like Solana and Algorand, USDC transactions are much faster and incur minimal fees, often just fractions of a cent, thanks to these networks’ high throughput and scalability.

不過,在 Solana、Algorand 這類區塊鏈上,USDC 轉帳速度極快且手續費極低(往往只需幾分之一美分),這都得益於其高效能與可擴展性。

Anyway, in most cases USDT’s wider network allows cheaper fees than USDC (Tron vs Solana blockchain, for that matter). But for small transactions the difference is negligible. So to most common users they will seem adequately same.

但整體來說,USDT 在更廣的網路(如 Tron)上提供了相對更低的費率,比起 USDC 在 Solana 的手續費更便宜些。對於小額交易者而言,差異幾乎可以忽略。因此一般使用者會覺得兩者差不多。

FDUSD (First Digital USD) is a newer stablecoin, and specific data on its transaction speeds and fees is still somewhat limited.

FDUSD(First Digital USD)身為新興穩定幣,其轉帳速度及費用的詳細數據尚有限。

FDUSD operates on Ethereum, a rather slow blockchain at the moment, and BNB Chain that emphasizes quick transaction times and relatively low fees to enhance its appeal for global payments.

FDUSD 目前支援 Ethereum(現階段較慢)和 BNB Chain,後者主打快速轉帳和低費用,更適合國際支付應用。

Anyway, it would be safe to say, that in general transaction speed and fees are to be improved here, compared to USDT on Tron and USDC on Solana.

總體而言,FDUSD 尚有提升空間,不論是轉帳速度或費用,相較 USDT(Tron)與 USDC(Solana)還需加強。

Market Strategy and User Base

市場策略與用戶族群

The market strategies of these stablecoins influence their adoption and the demographics of their user bases.

三大穩定幣的市場策略影響著其被採用的廣度與用戶分布。

USDT targets a broad user base, from retail traders to large institutions, offering high liquidity and availability across numerous exchanges. Its low transaction fees on certain networks, like Tron, make it attractive for high-volume traders and those seeking cost-effective transactions.

USDT 瞄準極廣泛的用戶,包括散戶交易者與大型機構,並且在各大交易所具有高度流動性與可用性。部分區塊鏈(如 Tron)更能提供超低費用,讓大額與追求轉帳效率的交易者更青睞。

USDC focuses on institutional adoption and integration into regulated financial services. Its partnerships with established financial institutions and fintech companies reflect a strategy aimed at building trust and facilitating large-scale financial operations.

USDC 著重於機構採用及與合規金融服務整合,與金融機構及科技公司合作,反映出其重建信任並便利大型金融業務的市場策略。

FDUSD is strategically positioning itself within the Asian markets, catering to users who require efficient cross-border payment solutions and compliance with regional regulations. Its growth in these markets indicates a successful alignment with the needs of its target user base.

FDUSD 則著重於亞洲市場布局,主打高效率跨境支付及區域合規,貼合目標用戶需求,也因此在相關市場成長迅速。

Risk Assessment and Sustainability

風險評估與可持續性

Each stablecoin faces risks that could impact its sustainability and market position.

每種穩定幣都面臨著可能影響其永續發展及市場地位的風險。

USDT's primary risks stem from regulatory scrutiny and the potential for legal actions that could limit its operations. Additionally, any significant loss of confidence due to reserve transparency issues could lead to a rapid decrease in its market capitalization and liquidity.

USDT 的主要風險來自監管審查及法律制裁的可能性,這些都可能限制其營運。再加上若因儲備資產透明問題而導致信心流失,有可能使其市值與流動性急遽下降。

USDC's risks are associated with regulatory changes that could impose new requirements or restrictions on stablecoins. While its compliance stance is a strength, it also subjects USDC to the uncertainties of evolving regulations.

USDC 的風險主要來自法規變動,如果未來針對穩定幣有新的要求或限制,USDC 雖然以合規為其強項,但同樣得面對法規所帶來的不確定性。

FDUSD faces the challenges of building market share in a

FDUSD 則面臨要在市場分額尚小的情況下持續成長與建立品牌信任的挑戰。 competitive environment and establishing long-term trust. Regulatory changes in its operating regions or broader geopolitical shifts could also impact its growth.

Conclusion

總結來說,雖然 USDT、USDC 和 FDUSD 都具有在加密貨幣市場中提供穩定性的基本功能,但它們在透明度、合規性、技術整合以及市場策略上的差異,則分別滿足市場上不同用戶的需求。

USDT 之所以能夠主導市場,主要歸功於其高流動性與廣泛採用,讓其成為眾多交易者和交易所不可或缺的選擇。然而,關於透明度與法規遵從性的持續疑慮,也帶來潛在風險。如果你希望持有的是全球最受歡迎、幾乎在世界各地都被接受的穩定幣,那麼 USDT 就是你的首選。

USDC 對於透明度與合規性的堅持,吸引了注重安全與合規性的機構及用戶。其技術整合及對創新的支持,也讓 USDC 在受監管市場與進階金融應用領域有良好成長潛力。如果你是一位守法公民(尤其居住在歐洲),USDC 是值得信賴且穩健的選擇。

FDUSD 作為新興穩定幣,積極抓住地區機會,著重合規及跨境交易效率。其未來能否成功,將取決於其建立信任並擴大其在全球金融體系中的整合能力。不過現階段,對於亞洲用戶來說,FDUSD 已經成為相當有趣的選擇,並逐漸有成為當地版 USDC 的趨勢。